Loan Settlement · 4 min read

Top 10 Mistakes People Make During Loan Settlement Negotiations

Discover how to settle your loan smartly and avoid common negotiation errors. Get expert tips for a quick, hassle-free debt resolution.

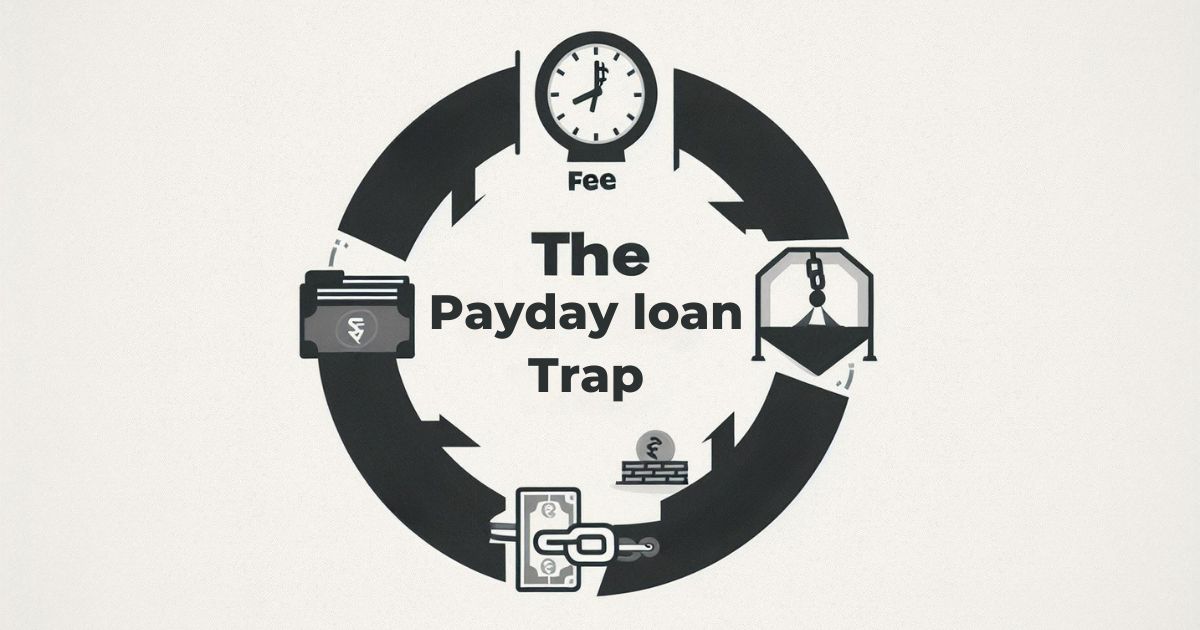

When financial pressures build and loan repayments become difficult, loan settlement negotiations often seem like a lifeline. This is the process where the lender and borrower agree to settle the loan for less than the original amount owed. While it can provide much-needed relief, understanding the process carefully is important to ensure a smooth and successful negotiation.

Whether negotiating alone or with the assistance of professionals, knowing the most common pitfalls can prevent you from landing in deeper financial trouble. Here are some of the most common mistakes people commit when settling loans on negotiations , and how you can steer clear of them.

1. Not Knowing What Loan Settlement Really Is

Many borrowers assume that paying off a loan clears their record completely. In reality, when a loan is settled, it is marked as “settled” on your credit report, indicating that the lender and borrower reached a mutually agreed resolution. This shows that the loan has been successfully managed and closed through negotiation.

2. Overlooking Key Details in the Settlement Process

A settlement brings much-needed financial relief, but understanding all its terms is essential. Being aware of each condition helps you make informed choices and ensures your loan is resolved in the most beneficial way possible.

3. Not Getting the Settlement in Writing

Verbal promises or oral understandings with creditors may end up in conflicts in the future. Always have the terms of settlement, amount, and payment schedule put in writing and signed by both parties. This written evidence is crucial to your own future financial security.

4. Settling Without Evaluating Financial Ability

Before finalizing any settlement, assess your repayment capacity carefully. Knowing your financial limits helps you negotiate better and prevents future payment difficulties. A well-planned settlement ensures lasting peace of mind.

5. Steer Clear of Contact with the Lender

Some individuals skip lender calls or postpone negotiations due to fear. Yet, honest and clear communication tends to lead to improved terms. More than half of lenders are willing to compromise with cooperative customers who intend to repay.

6. Not Negotiating Interest Waivers or Penalties

During negotiations, many people forget to discuss interest or late fee waivers. Lenders often agree to reduce such charges when you demonstrate your financial situation honestly. A skilled negotiator can help you save more during settlement.

7. Being Victimized by Third-Party Scams

Desperate borrowers sometimes resort to unverified agents or companies that claim instant loan settlements. Most of them are scams and may ask for up-front fees with no positive outcome. Always check the history of any debt settlement agency before enrolling.

8. Settling Without Verifying Legal Implications

Loan settlement at times includes legal jargon that lenders do not understand. Forgetting legal consultation or professional advice may create future issues, including claims or disputes on the part of lenders. Review settlement documents carefully at all times.

9. Disregarding Future Financial Planning

Once settled, most individuals do not restore their financial well-being. Without budgeting, the behaviours that led to the debt will persist. It’s important to establish a budget, save money, and monitor expenses once the settlement is made.

10. Believing Settlement Is the Only Option

Loan settlement is one of several ways to manage debt effectively. In some cases, restructuring or rescheduling payments may also work. A professional advisor can guide you on the best solution for your specific financial situation.

How to Negotiate Well

Know your outstanding amount clearly in advance of negotiations.

Negotiate with the lender in good faith regarding your difficulty.

Negotiate politely yet firmly when you ask for waivers or concessions.

Always settle payments via traceable methods (such as bank transfer).

Save all communication and receipts for record-keeping.

FAQs

Q1. What is a loan settlement negotiation?

It’s the procedure when the lender decides to settle your loan account after taking a portion of the outstanding amount, typically due to valid financial hardship.

Q2. Should I do this myself or pay a professional?

You can do it yourself, but where your case involves several loans or tricky terms, professional advice will help to ensure a reasonable agreement.

Q4. How can I avoid scams when settling?

Always make transactions directly with the bank or legitimate financial experts. Steer clear of those who request advance fees or make exaggerated claims.

Q5. Are there other options instead of loan settlement?

While options like restructuring or refinancing exist, loan settlement is often the most effective and fastest way to get financial relief when repayments become difficult. It helps you close your loan with a mutually agreed-upon amount, reducing stress and giving you a fresh financial start.

Disclaimer

The information shared in this blog is for general awareness only. Every borrower’s situation may differ, and the actual process or outcome can vary based on individual circumstances.